Mobile App Startups: Where to begin?

There is a lot that goes into making an app idea into a reality, and once you start thinking about how to actually get it done, the whole endeavour can be daunting. Often, breaking huge tasks into smaller, more manageable ones can help make things less overwhelming. In that vein, let’s break down ‘starting a company’ a bit.

Generally, you need to decide on a strategy on three fronts: capital, marketing, and tech. More in depth articles on each of these are forthcoming, but first, let’s talk about what they are and why you need to think about them.

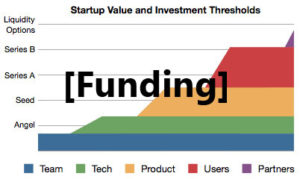

Your capital strategy basically relates to how you’re going to pay for things, or perhaps more accurately, who is going to pay for things. There are two main categories for this: either you pay for things yourself, or you get someone else to. There are advantages and disadvantages to both, and huge challenges as well. This is one of your biggest decisions, because it may entirely determine your strategy in the other two areas.

You need a marketing strategy because you need to build buzz long before your app comes out. Being able to show interest in your product can also help with raising capital and attracting a tech team. Finally, it can help you find early testers who will give you feedback before you go primetime – which is invaluable.

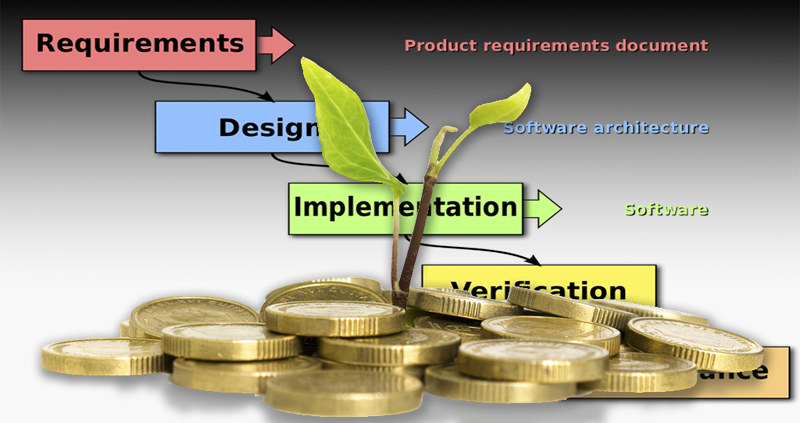

Lastly, your tech strategy. What technologies will you use to build your app? Who do you know that builds with those technologies? What do you need to think about as your app grows? How much will it cost at the beginning? How will that cost grow with your app’s popularity? Realistically, how much use will your app get? These are all important questions that will shape your tech strategy.

LithoByte has helped many startups develop their strategy in all of these areas. We’ve seen it all, and are intimately familiar with the pluses and minuses of each approach in each category. Do you have a question? Get in touch with us and we’d be delighted to talk to you about what you need to do to get your idea out there!

There is a standard path that startups go down when looking to raise institutional capital.

There is a standard path that startups go down when looking to raise institutional capital.